Promotion of the vineyard in French “Le French Paradoxe”

For nearly 30 years, Vinea Transaction has been surveying the vineyard in order to connect buyers and sellers throughout France.

From this daily work, an obvious observation emerges: the French paradox of the vineyard, which concerns the price of land.

Indeed, the vineyard in France has the particularity of presenting the most expensive or cheapest vines in the world a few kilometers away.

The most expensive land in the world

Obviously, the Bourgogne (from the Côte de Nuit to the Côte de Beaune), a diamond setting, can easily claim the title of the most expensive vineyard in the world.

The vineyard is currency like a work of art.

Clos de Tart, grand cru monopoly bought by François PINAULT in 2017 at € 250 million for 7.5 ha

· It is the same when LVMH got its hands on Clos des Lambrays, a nugget of the Côte de Nuit at more than 100 M € for only 8 ha.

VINEYARD = WORK OF ART

LEONARD DE VINCI – Salvator Mundi

Top 10: 100 to 380 M €

|

François PINAULT

|

LVMH |

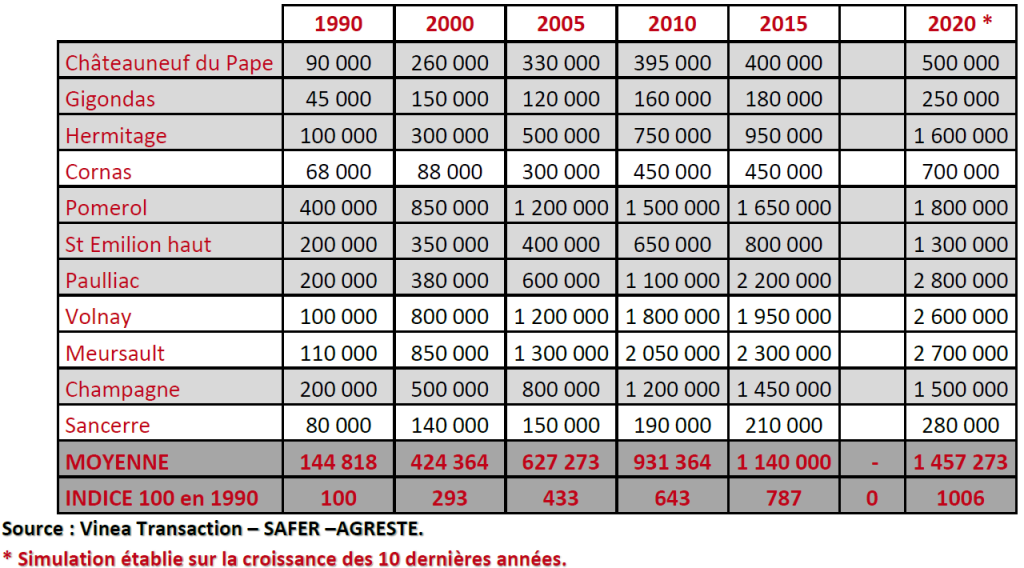

The table below (Panel of beautiful appellations) is instructive: in 30 years, the price of land in major appellations has multiplied by 10.

AVERAGE VALUE, PANEL OF PRESTIGIOUS APPELLATIONS (€ / HA)

With the exception of Champagne, depending on the sector and neighborhood, price differences can reach 50%. This table does not include the great classified growths of Bordeaux, nor the prestigious Clos Bourguignons which are off the market.

Opposite the Bourguignon market but only a few hundred km away, some plots of Beaujolais generics are traded between 5,000 and 10,000 € / ha.

Paradoxical?

No, it is quite simply the French Paradoxe, rarity and greed on the one hand and an appellation for which the historic Beaujolais Nouveau market is in very sharp decline.

The cheapest land in the world

This is the market for vines in generic appellations, IGP and table wines.

This vineyard represents 80% of the surfaces in France: Generic Bordeaux, Superior Bordeaux, Côtes and 1st Côtes de Bordeaux , Generic AOC from Languedoc, Corbières and Minervois , < a href = “https://www.vineatransaction.com/fr/domaine-viticole/vallee-du-rhone” target = “_ blank” rel = “noopener”> Ribs Generic Rhône and Côtes du Rhône Villages , Beaujolais, Muscadet, IGP, Table Wine.

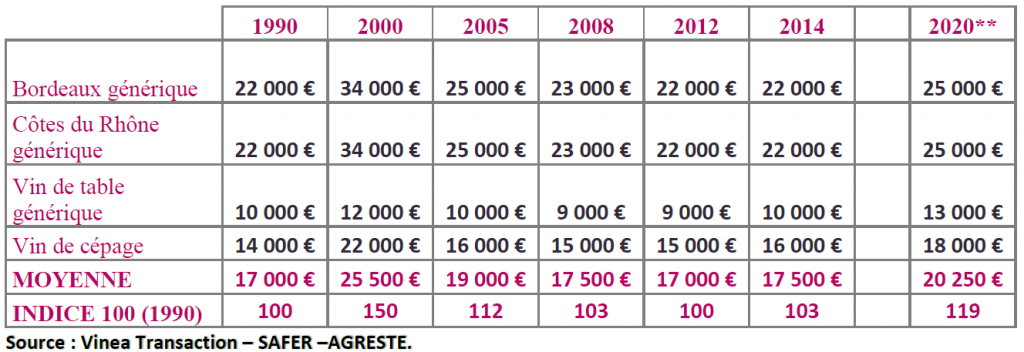

Singularly for 20 years, more than 560,000 ha (80% of the vineyard) have traded between 15,000 and 20,000 € / ha (see table).

While the major appellations have seen their prices increase tenfold, the price of “generic” land has only risen by 20% in 30 years.

VALUE OF GENERIC LAND (€ / HA)

Price per hectare for a vineyard in good condition (depreciation of up to 30% for a vineyard of poor quality)

** Simulation based on growth over the past 10 years

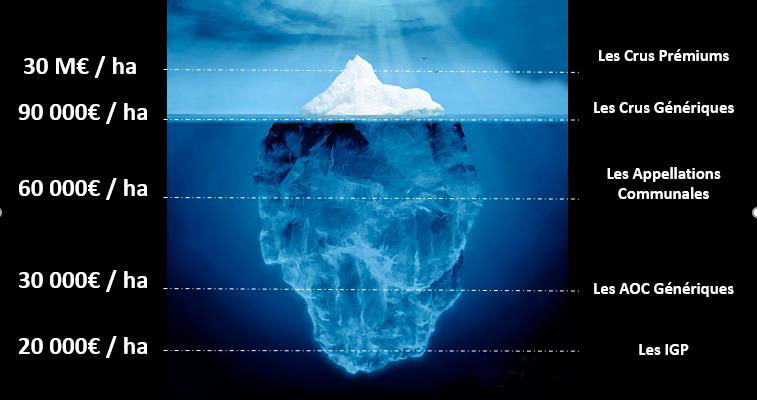

The price of land in France is an iceberg.

- 80% of the vines are, as we have seen, financially very accessible with a stable price and the remaining 20% correspond to the emerging part which implodes financially with its flagships, emblematic labels, classified Grands Crus in Gironde, mythical clos in Burgundy, intimate appellations of Côtes du Rhône Nord (Cornas, Hermitage, Côte Rôtie) or generous appellations of Côtes du Rhône Sud (Châteauneuf du Pape).

- The growth is certainly not over for this category which since 2000 has seen its prices multiplied by 10 for some. This market is boosted both by French investors, whether producers of wine or not, as well as by wealthy British, American or Asian families (the investors of tomorrow) oenophiles at heart.

Perspectives

- Continued price inflation in major appellations

- Impact of climate change on land prices, importance of irrigation

- Preponderance of organic wines including creation of an “Organic Vineyard” rating

- Asia: China to be the world’s leading producer and consumer

Atypical real estate

Vineyard under the control of major brands and financiers

Land in Champagne is unique, because it is a veritable “financial product” dependent on the big brands. The vines in Champagne do not offer the triptych of Epinal: The vineyard, the cellar and the castle. It is a vineyard “under contract”, of the big houses via rural leases.

It is a rare appellation where there are few large price differences (with the exception of the Côte des Blancs area).

- The Rosé de Provence : Land boom

In 2000, rosé was “cicada”, today a veritable tsunami, it seduces the world and becomes the only product to offer double-digit consumption growth. Result in 5 years, the price of land has tripled, flirting with 100,000 € / ha.

- The “offside” vineyards

Sweet wines, Sauterne, Muscats, Rivesaltes, Quart de Chaumes… These magnificent wines requiring hard work and high standards “come out” of the market, the fault of consumption which is constantly deteriorating. The consequence is relentless, declines in values of more than 50% are recorded for some appellations.

- Languedoc Roussillon undergoing total restructuring

Largest vineyard on the planet in the 1980s with more than 400,000 ha, Languedoc, with extensive restructuring, reduced its surface area by more than 50%.

The emergence is there: 70% of the vineyard is irrigable, the organic is developing excessively (20% of the surfaces), and soils identify themselves as the Pic Saint Loup which is negotiated at more than 60 000 €, / ha, a great first for Languedoc Roussillon.

- Bordeaux and Chinese investors

140 estates fly the Chinese flag in Bordeaux, unheard of, while the rest of France has only 10 Asian estates.

The impact on land remains relatively neutral because Chinese investors have access to generic appellations, outside the scope of speculation.